Roth ira phase out calculator

My wife and I were approaching our wedding day when I got the. Find out which IRA may be right for you and how much you can contribute.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

125000 to 140000 Eligibility phase out.

. One more considerationYour IRA401k money is subject to Required Minimum Distributions RMDs when you reach age 70-12. You can set up an IRA with a bank insurance company or other financial institution. The Roth IRA income limit refers to the amount of money you can earn in income before the Roth IRA maximum annual contribution begins to phase down.

The amount you can contribute begins to phase down when your annual income hits 125000 for single filers and 198000 for. Roth IRA Income Phase-Outs For Married Couples Filing Jointly You can contribute up to the Roth IRA limit if your 2022 MAGI is less than 204000 up from 198000 in 2021. Calculating Roth IRA basis helps distinguish between your contributions and growth of that money in your Roth account.

That means youre obliged to withdraw a fraction of your IRA401k accounts around 35 in the first year and increasing slightly each year thereafter and pay income taxes on that amount withdrawn. See Can You Contribute to a Roth IRA. If married filing jointly.

I Endured a Tech Layoff Twice. Roth IRA Contribution Limits. What is a Roth IRA Contribution Limits Roth IRA Conversion Withdrawal Rules IRA Rollover IRA Rollover Account What is a Rollover IRA.

Best IRA accounts in September 2022. Eligibility for Creating a Roth IRA. The Secure Act signed into law on December 20 2019 removed the age limit in which an individual can contribute to an IRA.

IRA Contribution Calculator. At some incomes the ability to contribute to a. You have until April 18 to contribute to a traditional IRA for the 2021 tax year.

Heres How I Created 11 Income Streams and Bulletproofed My Finances. However there are income phase-out limits based on your MAGI that determine whether youre eligible to open and how much you can contribute to a Roth. Other ways we can help.

129000 to 144000 Eligibility phase out. 66000 to 76000 deductibility phase out. A Roth IRA phaseout is the income level at which your contribution to these after-tax retirement savings accounts can be reduced or phased out completely.

A Roth IRA basis is the total amount of money youve contributed to your Roth IRA since opening the account. While that may not be. During 2014 my sister-in-law took what we later found out was an early withdrawal sending my wife half of the amount.

An individual retirement arrangement IRA is a tax-favored personal savings arrangement which allows you to set aside money for retirement. People who are 50 and older can contribute up to 7000. In the US today very rarely is the term DC plan used to refer to pension plans.

Your deduction begins to decrease phase out when your income rises above a certain amount and is eliminated altogether when it reaches a higher. A Roth IRA even via a conversion has the potential to benefit your retirement and legacy planning. As long as you are still working there is no age limit to be able to contribute to a Traditional IRA.

For more information or to do calculations involving each of them please visit the 401k Calculator IRA Calculator or Roth IRA Calculator. 68000 to 78000 deductibility phase out. However when annuity owners withdraw or annuitize the contract they will have to pay ordinary taxes based on how much money was paid in premiums and how much that money.

These brokers come out on top. Your contribution can reduce your taxable income which in turn would reduce the amount of tax you owe. 7 min read Sep 01 2022.

The payout phase can last for several years or until the owner dies. The account holder does not have to pay taxes on the money in the account during the accumulation phase. Learn how your business can utilize this financial technique.

If youre under age 50 you can contribute up to 6000 for 2021. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account. These funds put us in a higher tax bracket we lost out ability to deduct our traditional IRA and increased our tax liability greatly.

Both are under 59 12. Calculate your Roth IRA basis by adding up all your contributions and subtracting any distributions youve made. To put money in a Roth IRA you must have less than a certain amount of taxable income from work like wages overtime or a bonus.

According to the IRS the amount of Roth IRA contributions that you can make for 2022 depends on whether your filing status is single or married and can change each year. Double-entry accounting can help track your finances and keep your books in balance. Tax Year 2021.

We later recieved a 1099-R for the distribution. If I earned more than 6000 in 2021 7000 if I was age 50 or older by the end of 2021 is there a limit on how much I can contribute to a. Calculate your IRA contribution limit.

So thats an overview. If youre single or file as head of household the ability to contribute to a Roth begins to phase out at MAGI of 129000 and is completely phased out at 144000 for tax year 2022. The amount you can invest each year is limited based on your filing status.

In 2022 the limits are 129000-144000 for single filers 204000-214000 for married filing jointly. Social Security benefits calculator. Do you know what it takes to.

They are more likely to be referred to by their programs such as 401k the 457 plan or IRA etc. There are several different types of IRAs including traditional IRAs and Roth IRAs. As discussed in my column about Roth IRA contribution limits the maximum a person can contribute to a Roth IRA in 2022 is 6000 7000 for those age 50 and up.

Check out our picks for the top Roth IRA account providers below.

What Is The Best Roth Ira Calculator District Capital Management

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculators

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

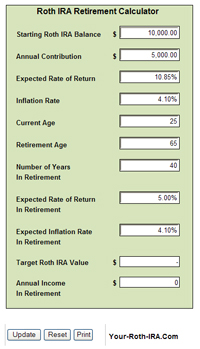

Roth Ira Calculator Roth Ira Contribution

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Ira Calculator See What You Ll Have Saved Dqydj

Roth Ira Calculator Calculate Tax Free Amount At Retirement

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal